This is part two in a five-part series of short papers on the EB-5 Immigrant Investor Visa program. If you missed part 1 read it, here.

Currently EB-5 is only a small part of foreign direct investment (FDI), which is “investment from one country into another (normally by companies rather than governments) that involves establishing operations or acquiring tangible assets, including stakes in other businesses.”

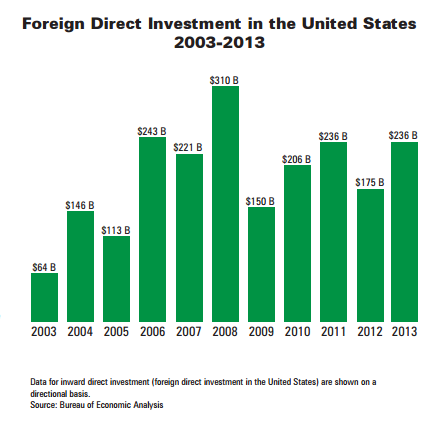

As Graph 1 shows, before the economic crisis of 2008 and 2009, U.S. FDI reached a peak of $310 billion in 2008, falling by more than 50 percent the following year. After steadily increasing again between 2009 and 2011, foreign direct investment tumbled from $236 billion in 2011 to $175 billion in 2012, a decline of 26 percent, reflecting the weakening global economy. However, FDI got back on track in 2013, increasing 35 percent to $236 billion, and increasing as percentage of U.S. gross domestic product (GDP) from 1.1 percent in 2012 to 1.8 percent in 2013.

Graph 1

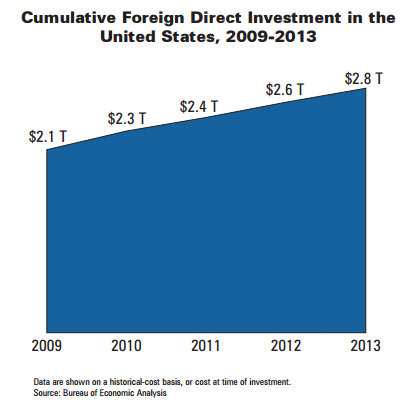

Graph 2

The program aims to attract foreign investors through a variety of approaches, ranging from state and local incentives to federal programs such as grants, tax and financial assistance, funding proposals and others. Under the program, the administration has sought to promote the EB-5 program and has touted the post-2012 surge in FDI as an outgrowth of the “aggressive enhancement and expansion” of the SelectUSA initiative. An expanded EB-5 program has the potential to bring even greater foreign direct investment to the U.S. and serves to diversify the vehicles for foreign investment.

Source for both graphs:Organization for International Investment, “Foreign Direct Investment in the United States: 2014 Report”

Continue reading PART 3: DEMAND OF EB-5 VISAS

Full EB-5 Visa series available here.