This fact sheet provides information and demographic details about mixed status families living in the United States. It highlights mixed status families who file tax returns listing both U.S. citizens with Social Security Numbers (SSN) and family members with Individual Taxpayer Identification Numbers (ITIN).

What is a mixed status family?

- Mixed status families are families in which one or more family members are U.S. citizens or lawful permanent residents (green card holders) and some are undocumented without legal immigration status. Approximately 16.2 million people in the United States live in a mixed status family. These families house an estimated 6.1 million U.S. citizen children.

How many mixed status families file tax returns?

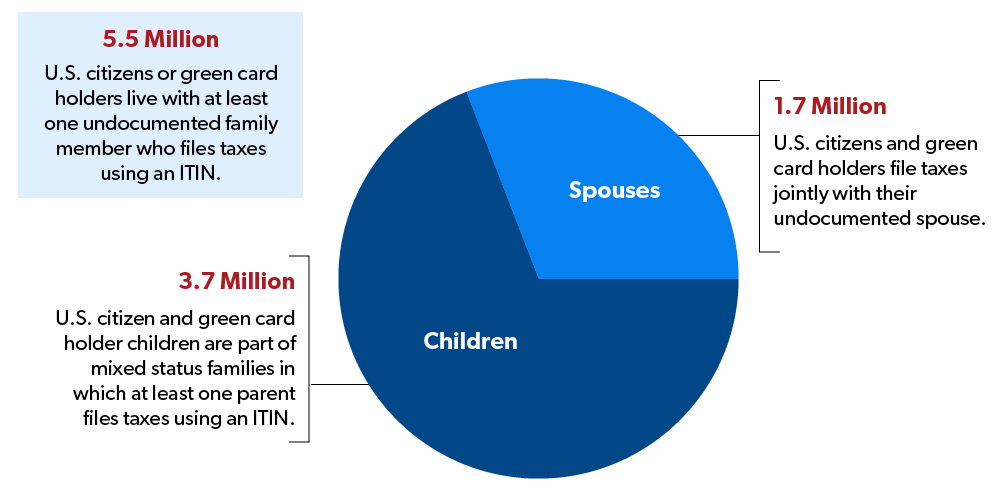

- 5.5 million U.S. citizens or green card holders live with at least one undocumented family member who files taxes using an ITIN.

- 1.7 million U.S. citizens and green card holders file taxes jointly with their undocumented spouse.

- 3.7 million U.S. citizen and green card holder children are part of mixed status families in which at least one parent files taxes using an ITIN.

Which states have the largest number of U.S. citizens in mixed status families filing taxes?

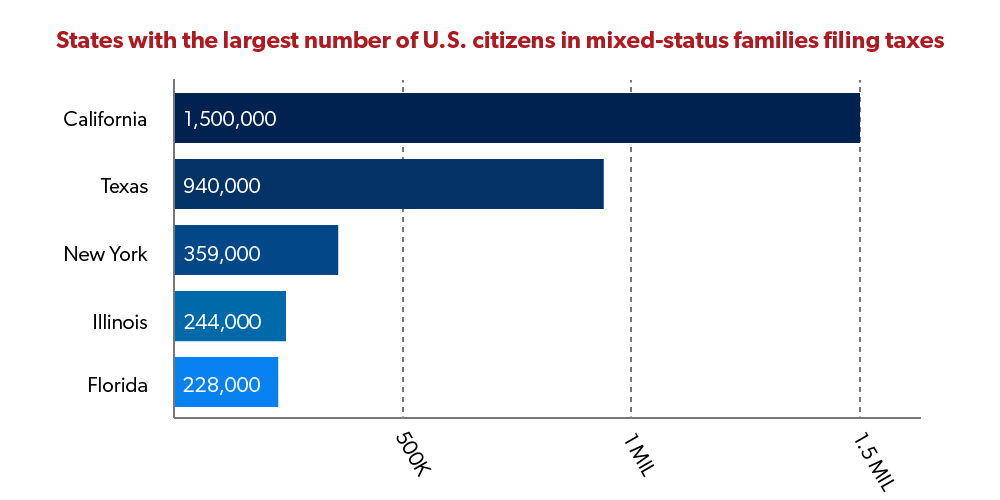

- California (1.5 million people)

- Texas (940,000 people)

- New York (359,000 people)

- Illinois (244,000 people)

- Florida (228,000 people)

Why don’t undocumented spouses obtain legal status?

Undocumented immigrants are not automatically eligible for legal status upon marrying a United States citizen or lawful permanent resident. Rather, they must undergo a lengthy, complicated legal process filled with obstacles which could prevent them from accessing a green card and which, in some cases, could instead result in their deportation.

Undocumented immigrants who have been present in America for more than six months are barred by statute from accessing a green card unless they first leave the country for three years. Undocumented immigrants who have been present in the U.S. for more than 1 year face a similar bar from accessing legal status but must leave the country for 10 years before regaining eligibility. These bars may only be waived if the absence would cause extreme hardship to a U.S. citizen spouse or child.

Other barriers which prevent undocumented spouses from pursuing legal status include the expensive legal and administrative costs, the potential for being declared ineligible due to a wide array of “inadmissibility grounds,” and the extensive time and paperwork required to prove that a marriage is legitimate.

Were mixed status families eligible for stimulus checks from the CARES Act?

No, U.S. citizens in mixed families were denied stimulus payments, provided by the CARES Act, solely because an ITIN filer was listed on their tax returns. The CARES Act withholds economic relief from all families who identify a spouse or claim any dependent using an ITIN number, including children and other dependents, such as a parent.

Why should mixed status families be included in COVID-19 relief legislation?

COVID-19 does not distinguish on immigration status, and its effects are being felt by all. Individuals who need assistance should not be penalized because of who their parents are or who they are married to. Excluding U.S. citizens in these families from COVID-19 relief legislation will contribute to the diminished health and well-being of these families and of our country and will slow our economic recovery. Providing stimulus checks and other benefits in COVID-19 legislation to mixed status families will benefit the children in these families and provide them with resources critical to their health and development.

Is there pending legislation that would provide relief to mixed status families?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act (H.R. 748), passed in March 2020, barred mixed status families from receiving stimulus checks. Under the CARES Act, U.S. citizen members of mixed status families could receive a stimulus payment only if they filed a tax return which did not list a spouse or dependent who used an ITIN number. Accordingly, many U.S. citizens in mixed status families had to choose between filing jointly with their families or filing individually in order to receive a stimulus payment.

Introduced by Representative Nita Lowey (D-New York), the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act (H.R. 6800) passed the U.S. House of Representatives on May 15, 2020. As House Democrats’ most recent comprehensive coronavirus relief bill, the HEROES Act would respond to this problem by allocating stimulus payments to all taxpayers who pay taxes and all dependents listed on a tax return, regardless of their immigration status. The HEROES Act would provide a retroactive payment for mixed status families under the CARES Act as well as a second wave of payments for all taxpayers.

In the U.S. Senate, Senators Marco Rubio (R-Florida) and Thom Tillis (R-North Carolina) introduced the American Citizen Coronavirus Relief Act (S. 4071) on June 25, 2020. This bill would amend the CARES Act to retroactively provide stimulus payments for U.S. citizen spouses who filed jointly with ITIN filers, ensuring that American citizens are not denied stimulus payments because of who they are married to. It would also provide payments for U.S. citizen children in mixed status families if at least one parent filed using a Social Security number.

More recently, on July 30, 2020, Senators Mitt Romney (R- Utah), Steve Daines (R-Montana), Bill Cassidy (R- Louisiana), and Marco Rubio (R- Florida) introduced the Coronavirus Assistance for American Families (CAAF) Act (S. 4381), which would authorize a second round of stimulus payments. The CAAF Act would provide a $1,000 stimulus payment for all U.S. citizens who filed a tax return, including U.S. citizens who filed jointly with an ITIN filer. This bill would provide stimulus payments for U.S. citizen dependents in mixed status families — both adult and children dependents — if at least one taxpayer filed using a Social Security number.

* We would like to thank Daniel Bowman, policy intern, for his assistance with this post.