Immigrants play an increasingly pivotal role in the U.S. economy. Every American benefits from the taxes that immigrants pay and from the money they spend on consumer goods and services. Their participation in the economy creates a demand for goods and services, thereby boosting job growth. This fact sheet is one of a series of papers examining the various roles immigrants play in our economy. It highlights research illuminating the role that immigrants play in helping cover the cost of public services at the local, state, and federal level, and how their spending contributes to the U.S. economy. These immigrant contributions are often overlooked, but they significantly benefit all Americans.

The tax contributions of immigrants

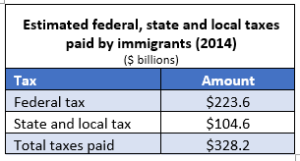

Immigrants pay the same taxes we all do — federal income tax, social security tax, Medicare tax, property tax, state income tax, sales tax, and so on. The taxes they pay help to cover federal and state services that benefit communities everywhere. In 2014, immigrants paid an estimated $328 billion in state, local, and federal taxes. Immigrants paid more than a quarter of all taxes in California, and they paid nearly a quarter of all taxes in New York and New Jersey.

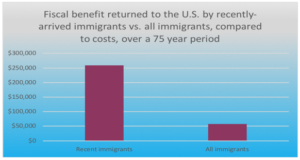

A recent analysis of U.S. Census data has found that almost half of immigrants coming to the U.S. between 2011 and 2015 were college graduates. This compares to 27 percent of immigrants who arrived from 1986-1990. As a result, the fiscal benefit of recently arrived immigrants over a 75-year period is much higher ($259,000, on average) than that of all U.S. immigrants, past and present. The average fiscal benefit was $259,000 for immigrants who arrived during the 75-year period, while the average fiscal benefit for all immigrants was $58,000. The trend toward higher education levels in our immigration flows is expected to continue or intensify, ensuring that immigrants will continue to be a fiscal boon for our country.

Overall, educated immigrants and educated U.S.-born workers with similar characteristics have about the same fiscal impact, according to the National Academies of Sciences, Engineering and Medicine. The two groups pay more taxes because individuals with higher levels of education will earn more, regardless of whether they are immigrants or born in the United States.

Immigrants paid in 2014 an estimated $223.6 billion in federal taxes. This includes $123.7 billion in Social Security tax and $32.9 billion in Medicare tax. On the state and local level, immigrants paid $104.6 billion in taxes. The combined contribution of immigrants in 2014 was $328.2 billion in taxes. In California, immigrants pay 28 percent of the total taxes in the state.

Between 1996 and 2011, the net contribution of immigrants to the Medicare Hospital Insurance Trust Fund was $182 million. During the same period, the U.S.-born population, which is on average older, received $69 billion more in benefits from the fund than they contributed in taxes. Immigrants are helping to ensure Medicare remains viable.

Undocumented immigrants contribute to the economy

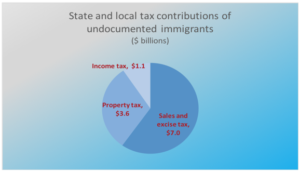

It is not only immigrants, who are legally present in the U.S., who are paying taxes. Undocumented immigrants make important contributions as well. An analysis based on the U.S. Census and other data estimated that undocumented immigrants paid $11.7 billion in state and local taxes. If they had a pathway to secure legal status, they would likely earn more and, consequently, more of their income would be on the books. Their state and local tax contributions would increase accordingly, by an estimated $2.2 billion.

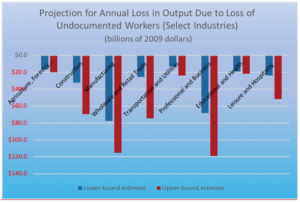

Removal of undocumented workers would represent a major loss for the U.S. economy. One analysis done in 2016, based on data from 2012, estimated that undocumented workers represented 5.6 percent of the U.S. workforce. Even back in 2012, there were not enough unemployed workers available to fill jobs left by undocumented workers if these workers were all removed by the government. The resulting labor shortage, according to this analysis, would cause private sector employment to fall by 4 million to 6.8 million workers, and this would translate to a reduction in private sector output of between $381.5 billion and $623.2 billion annually. In other words, according to this analysis, private sector activity would decline between 2.9 percent and 4.7 percent annually. Certain industries that are more dependent on undocumented workers, such as agriculture, construction, leisure and hospitality, would be particularly hard hit. The U.S. labor market has become much tighter since 2012. In April 2018, the U.S. had more total job openings than unemployed workers. The removal of undocumented workers would lead to more job openings and fewer individuals to fill them.

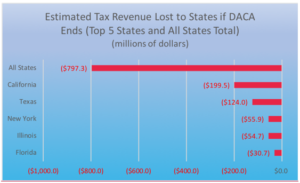

Young undocumented immigrants who grew up in the United States and are participants of the Deferred Action for Childhood Arrivals program (DACA) currently have permission to work legally in the U.S. The vast majority, approximately 91 percent, are currently employed. They pay an estimated $1.6 billion in state and local taxes. If DACA expires without Congress passing a permanent solution for these individuals, states and localities collectively face a loss of almost $800 million in tax revenue. That is because, if they lose work authorization, their income would drop, and more of it would be “off the books.” On the other hand, if Congress provides a path to citizenship for these individuals, states and localities would see their revenue boosted by about $50 million.

Immigrants are a net benefit

Calculating the cost of services to immigrants compared to how much immigrants pay in taxes is dependent on the time frame examined and the level of the government considered-federal, state, or local. The net fiscal contribution of a new immigrant and immigrant’s children over a 75-year period is positive. The average benefit to all levels of government is $259,000. An immigrant with a college degree contributes more during that same period, approximately $800,000.

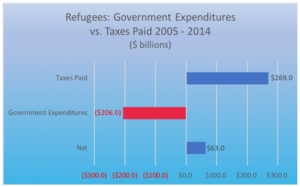

Refugees are also a positive net benefit to the U.S. economy. A recent government study estimated that, in the ten-year period between 2005 and 2014, total government expenditures on refugees were $206 billion, but in the same period refugees paid federal, state and local taxes of $269 billion. Another study estimated that refugees earned $77 billion and paid $20.9 billion in taxes in 2015 alone.

In general, more services are provided to immigrants at the local level than at the federal level because immigrants have more children, on average, than the U.S. born population. The education costs spent on the children of immigrants is borne at the local level. It should be noted that the expense of educating immigrants themselves, most of whom migrate here as adults, and their older children, have been borne by the government of their home country. On the other hand, education is an investment, and educated children grow up to be adults who earn more and pay more in taxes. The U.S. born children of immigrants, also known as the second generation, pay more in taxes and use fewer services at all levels of government when compared to their immigrant parents, also known as the first generation, and the rest of the U.S. born population.

Immigrant income and spending power

In 2014, immigrants earned a total of $1.3 trillion in wages, or 14.2 percent of all income earned in the United States. The percentage of income earned is greater than the percentage of immigrants in the general population (13.2 percent). This disparity, in part, occurs because a greater percentage of immigrants are in their working and income-earning years than the U.S. born. The total spending power of immigrants in the U.S. – the total income they earn minus the taxes they pay – was $927 billion in 2014, or more than 14 percent of the total American spending power. The spending power of refugees in the U.S. was estimated to be $56 billion in 2015. Much of this revenue goes back into the economy, creating demand for goods and services, which, in turn, help create jobs. The U.S. economy is stronger because of immigrants.

Conclusion

Regardless of their status, immigrants pay taxes and spend money in local economies. Without these important economic contributions from immigrants, the U.S. economy would be smaller, and governments at all levels would see revenues decline without the taxes paid by immigrants. Research analysts have examined the economic contributions of immigrants and have concluded that, when looking at the taxes paid by immigrants verses the cost of services provided to them, immigrants have a significant positive balance. This time period includes the cost and contributions of their children. While local governments bear the cost of educating immigrant children, education is an investment, yielding higher returns in terms of income earned and taxes paid. In recent years, the net economic contributions of immigrants has increased in tandem with the rising education levels of recent immigrants. Immigrants have helped make the American economy the strongest in the world.

*Special thanks to Maurice Belanger for his contributions to this series.

To see all papers in the Immigrants as Economic Contributors series, click here.

Economic Contributors IV-Taxes And Spending PDF

Author: Dan Kosten